The Employees’ Provident Fund (EPF) is crucial for fostering a culture of savings among employees, aiming to secure their financial stability for retirement. This system involves monthly contributions from both employers and employees.

Withdrawal of provident fund contributions is generally restricted until retirement, with certain exceptions. EPF system registered employers are needed to give monthly returns as an PF compliance

Timely submission is crucial, as PF returns must be filed on or before the 25th of each month. The user-friendly Unified Portal now simplifies the filing of PF returns.

The PF-registered employers in India also needed to have mandatory regular monthly filing

What is the Employee Provident Fund?

The Employee Provident Fund (EPF) is a retirement benefit aimed at providing financial security to employees post-employment. This social security initiative plays a key role in protecting workers’ interests during retirement.

The Applicability of EPF

20 or more employees need to apply the EPF scheme in their establishment or factories. Recent changes have reduced this threshold to 10 employees. Additionally, any establishment, regardless of size, may voluntarily opt to be covered under the EPF Act.

Criteria for Applying for EPF

Individuals employed in a registered establishment or by a contractor associated with it are eligible for EPF. Eligibility is determined by a monthly salary limit of up to Rs.15,000, which includes the Basic Salary and Dearness Allowance.

Investing in an Insurance Scheme to Contribute to the EPF

EPF contributions are made by both employers and employees, each contributing 12% of the salary to the fund. Additionally, the Central Government contributes 1.16%. This government contribution ensures the scheme’s wide reach and coverage.

Contribution to the EPF through an Insurance Scheme

Employees who contribute to the Provident Fund are also covered by an insurance scheme. Employers contribute 0.5% towards this insurance, providing a maximum payout of Rs.100,000 in case of an employee’s death during service.

Employees’ Provident Fund Pension Fund

If you are part of the Provident Fund at your workplace, you automatically join the Pension Scheme as well. This means your employer helps save for your future by contributing a portion of your basic salary-specifically, 8.33%-towards your pension, but only up to a maximum basic salary of Rs.15,000.

A minimum of ten years of service is required to qualify for a monthly pension, with full pension eligibility after 20 years of service. This highlights EPF’s long-term commitment to the financial security of retirees.

Advantage of EPF Registration and EPF Compliance

The EPF offers several benefits, ensuring financial stability for employees during and after their careers:

1. Advances and Withdrawals Payments:- Employees can take advances or make withdrawals for various purposes, such as education, medical expenses, home loans, or marriage.

2. The Nominee and Legal Heirs’ Entitlement:- In case of a member’s death, nominees or legal heirs are entitled to the PF amount.

3. Contributors of Pension by Employers:- Contribution of PF also pension fund is accessible post retirement by the employers.

4. Employees’ Deposit Linked Insurance Scheme Insurance:- The scheme which offers whole payment to the beneficiaries i.e. Employees’ Deposit Linked Insurance (EDLI) when the employee is deceased during service.

5. Tax Benefits (EEE Scheme):- The Exempt, Exempt, Exempt (EEE) scheme mentions withdrawals, earned interest, and contributions are free of tax.

6. Interest Payment on Savings:- EPF contributions earn interest, enhancing employees’ savings over time.

7. PF Account Portability:- PF accounts are transferable between employers, maintaining continuous benefits for employees.

Annual EPF Compliance Requirements

The EPF is a government-regulated savings scheme for employees in various sectors in India, managed by the Employees’ Provident Fund Organisation (EPFO). Companies with over 20 employees are required to register with the PF department, while those with fewer employees can opt for voluntary registration. The essential compliance essentials under the EPF Act comprise:

- Employees’ Provident Fund Registration: Mandatory for businesses with 20 or more employees, with voluntary registration available for smaller establishments.

- Employees Contributions: Both employers and employees must contribute 12% of the salary, with regular deposits to the PF department.

- The Deposit and Submission Timeline: Contributions need to be deposited by the 15th of each month, with monthly EPF reports submitted by the 25th.

- New Employee Enrollment: New employees must be enrolled promptly, with all necessary documentation completed.

EPF (Employees’ Provident Fund) Compliance Checklist

Key compliance provisions include:-

- Payment of PF, Pension, and Insurance dues by the 15th of the following month.

- Submissions of employee details, contribution records, and other relevant information within stipulated timelines.

- Timely submission of the annual consolidated contribution statement by April 30th.

Employers must adhere to these guidelines to maintain compliance with the EPF Act, ensuring both effective system functioning and legal conformity.

Withdrawal Rules Under the EPF Act. 1952

- The EPF Act outlines specific conditions for fund withdrawal:

- Complete Withdrawal:

- Upon reaching 58 years of age.

- Upon retirement.

- If unemployed for over two months.

- In case of death, nominees or legal heirs can withdraw the funds.

Partial Withdrawal:

For covering costs related to education, healthcare, home loan repayments, marriage expenses, property purchases, business shutdowns, natural disasters, early retirement, or extended periods of unemployment.

- These rules offer flexibility to accommodate diverse financial needs during employment.

- Penalties for EPF Non-Compliance.

- Penalties for failing to comply with the EPF Act are structured to ensure adherence.

- Interest on Delayed Payments: 12% annual interest for delayed contributions.

In the event that contributions are late, a penalty of 12% per year interest will be applied.

- Late Payment Penalties:

- Up to 2 months: 5% interest.

- 2-4 months: 10% interest.

- 4-6 months: 15% interest.

- More than 6 months: 25% interest.

Timely contributions are essential for employees’ financial security, with penalties in place to encourage compliance.

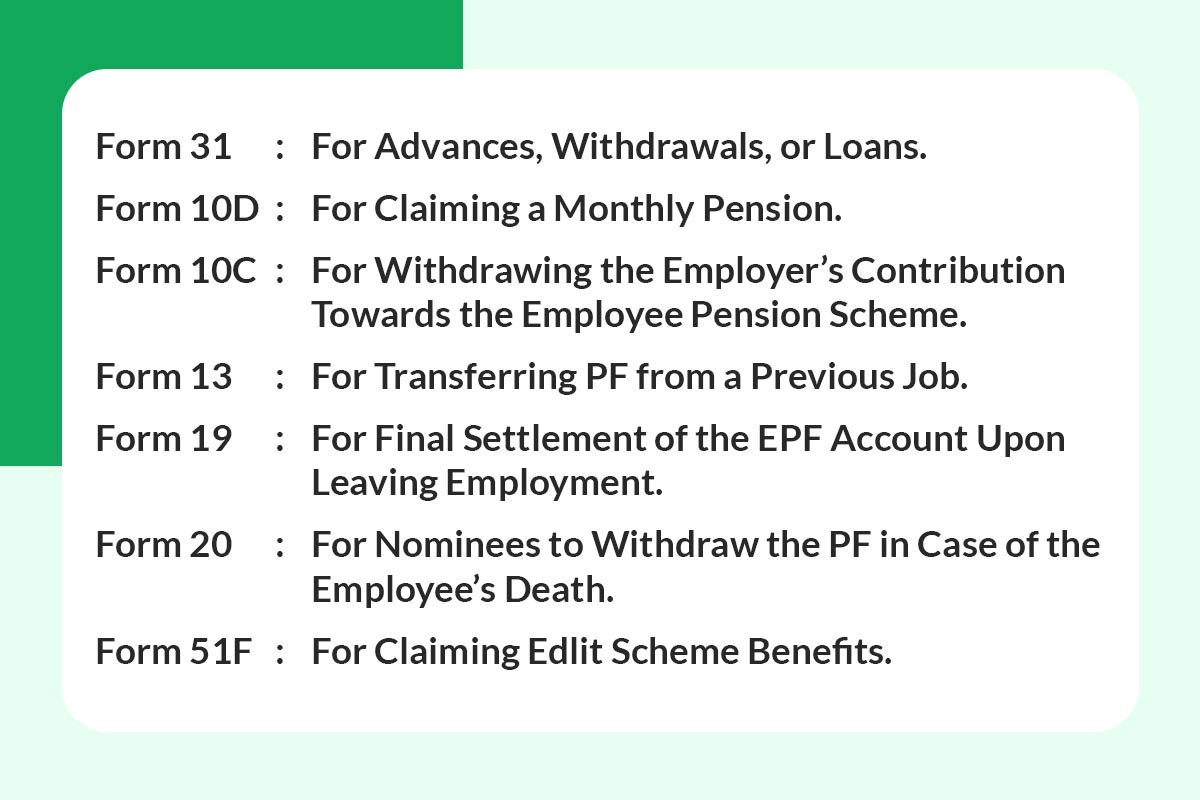

Essential EPF (Employee Provident Fund) Forms

Key forms required under EPF compliance include:

Proper form submission is critical for managing transactions related to EPF accounts.

Why Choose EazeMax Software for EPF Compliance Services?

EazeMax Software offers comprehensive PF compliance solutions, assisting clients from registration through the completion of all necessary compliance formalities. Following these standards ensures the smooth functioning of the EPF system and protects employees’ financial security.

Ensuring EPF compliance is vital for maintaining the system’s integrity, with punctual contributions and precise reporting playing a key role in supporting the workforce’s welfare.

Frequently Asked Questions For PF Compliance

Q.1 What is EPF compliance, and who is obligated to follow it?

EPF compliance involves following the rules set by the Employees’ Provident Fund Organisation (EPFO). It is mandatory for employers with 20 or more employees.

Q.2 How can a company complete the EPF registration process in India?

To register for EPF, businesses must access the EPFO’s official website and adhere to the registration guidelines provided.

Q.3 What is the role of UAN in EPF Compliance?

The Unique Account Number (UAN) is a distinct identifier assigned to employees, created by the PF department when employers register.

Q.4 Why is Form 31 used in EPF Compliance?

Form 31 is utilized for withdrawals, advances, or loans from an employee’s EPF account as per the rules.

Q.5 What steps should an employee take to receive a monthly pension through EPF?

To receive a monthly pension, employees must fill out and submit Form 10D, which is specifically for pension claims.

Q.6 What is the purpose of Form 10C in EPF?

Form 10C is used to claim benefits under the Employee Pension Scheme (EPS) and to withdraw contributions made by the employer.

Q.7 Is it possible to transfer EPF funds when changing jobs?

Yes, employees can transfer their EPF balance by submitting Form 13, which helps consolidate contributions from previous employment.

Q.8 How does the Minimum Wages Act, 1948, influence wage practices?

The Act ensures fair wages by prescribing minimum pay standards across various industries.

Q.9 What is the function of Form 20 in EPF compliance?

Form 20 allows legal heirs to withdraw funds from a deceased employee’s EPF account.

Q.10 What does Form 51F accomplish in EPF?

Form 51F enables nominees to claim benefits under the Employees’ Deposit Linked Insurance Scheme (EDLI).

Q.11 How are contributions to the EPF calculated for both employees and employers?

Both employees and employers contribute 12% of the employee’s basic salary towards the EPF.

Q.12 Can smaller companies voluntarily opt into EPF Compliance?

Yes, companies with fewer than 20 employees can choose to register voluntarily to provide EPF benefits.

Q.13 What tax exemptions are available for EPF Contributions?

EPF falls under the EEE (Exempt, Exempt, Exempt) category, offering tax-free contributions, interest, and withdrawals.

Q.14 How is the EDLI scheme connected to EPF Compliance?

EPF compliance includes contributions to the EDLI scheme, which provides financial assistance to families in case of an employee’s death during service.

Q.15 Are EPF funds accessible for specific personal needs?

Yes, partial withdrawals are allowed for purposes like education, medical emergencies, home loan repayment, marriage, and more.

Q.16 How can EPF be transferred when switching employers?

To transfer EPF, employees must submit Form 13, which links the funds from the old employer to the new one.

Q.17 What are the responsibilities of principal employers regarding contractors and EPF Compliance?

Principal employers must ensure that contractors comply with EPF regulations by checking their registration with EPFO and monitoring regular PF contributions.

Disclaimer: The information provided here is sourced from reliable and verified resources and published after careful review. However, any inaccuracies or changes in details should be regarded as human error. Our blog aims to deliver updated content, and we welcome any queries related to the blog’s subject matter. Please note that we do not offer consultancy services and, therefore, cannot respond to such requests. Our responses are based on practical insights, and we recommend cross-verifying information with professional authorities for complete accuracy.