The Provident Fund (PF) is a significant fund accumulation initiative by the Government of India designed to assist the workforce in securing their future financial needs.

In return for keeping funds within the government treasury, the government offers attractive interest rates, enhancing financial security for individuals.

Explore the key Processes Involved in Registering for an employee’s PF and ESI

How the registration process for the Employee Provident Fund (PF) and Employee State Insurance (ESI) works in India. It includes checking employee eligibility, collecting required documents, submitting the application online, obtaining approval, and ensuring ongoing compliance. This guide helps you understand the fundamentals of these essential employee benefits.

Registration of Employees’ Provident Fund (PF)

Employers with a minimum of 20 employees are legally required to enrol in the EPF scheme within one month of reaching the 20-employee threshold. Smaller companies, even if they do not meet the minimum workforce size, have the option to register voluntarily. Employees earning above Rs 15,000 per month are not required to join the EPF scheme.

Registration of Employees’ State Insurance (ESI)

Employers must initiate ESI Registration when they hire more than 10 employees. This requirement also extends to employees with lower earnings.

Under the ESI Act, employees earning Rs 15,000 or less per month are mandated to contribute 0.75% of their salary, while the employer contributes 3.25% for ESI. For successful ESI registration, employers must provide an upfront contribution for six months.

Benefits of ESIC (Employees’ State Insurance Corporation) Registration

Enrolling in the ESIC scheme provides numerous advantages:

- Sickness Benefits:- Employees receive 70% of their salary for up to 91 days annually if they suffer from a certified illness.

- Medical Benefits:- Coverage extends to the employee and their family members.

- Maternity Benefits:- Pregnant employees are eligible for paid maternity leave.

- Survivor Benefits:- In case of the employee’s death during service, dependents receive 90% of the salary as a monthly pension.

- Disability Benefits:- Coverage similar to survivor benefits in the event of disability.

Benefits of Employee PF Registration

A pre-set interest rate is earned on contributions held under EPF India.

Around 8.5% of the employer’s contribution goes towards the Employee Pension Scheme, aiding in a robust retirement fund for employees.

Emergency withdrawals from the EPF fund are allowed.

Income generated from EPF contributions is tax-exempt.

Effective February 23, 2020, all new businesses are required to complete ESIC and EPF registrations during incorporation, as individual registrations through the Shramsuvidha portal will no longer be available.

The ESI Scheme Applies to:

- Shops

- Hotels or restaurants engaged solely in sales, not manufacturing.

- Cinemas, including preview theatres.

- Road Motor Transport Establishments.

- Newspaper establishments not classified as factories under Sec. 2(12).

- Private educational and medical institutions managed by individuals, trusts, societies, or other entities, including corporate, joint-sector, charitable, and privately-owned hospitals, diagnostic centres, and nursing homes.

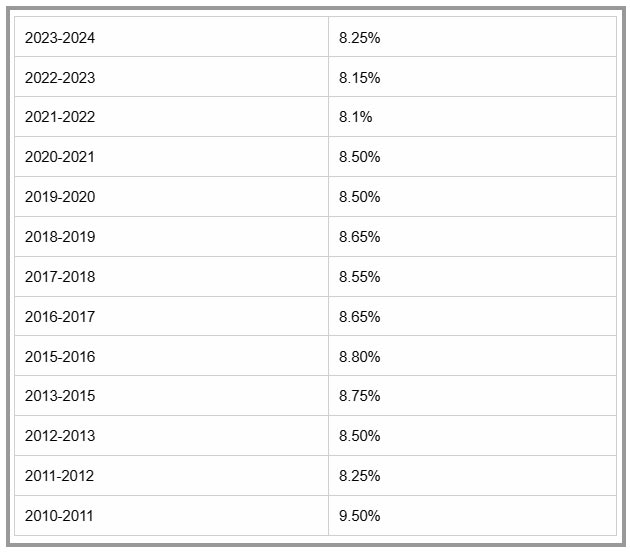

Employee PF Interest Rates Over the Past 11 Years ownership hospitals, nursing homes, diagnostic centres, and pathological labs.

Interest Rates of Employees’ EPF in the Last Eleven Years

Frequently Asked Questions on ESI & PF Scheme for Employees

Q.1 How does the ESI scheme benefit employees?

The ESI scheme offers comprehensive medical coverage to employees registered with ESIC, ensuring support during periods of disability and incapacity to work. It also provides financial compensation for wage loss due to illness, maternity leave, or workplace injuries, and extends healthcare benefits to family members.

Q.2 Who manages the ESI Scheme?

The ESI Scheme is managed by the Employees State Insurance Corporation (ESIC), a semi-government body consisting of representatives from employers, the Central Government, employees, medical professionals, state governments, and Parliament members. The Director-General of ESIC acts as the chief executive officer.

Q.3 How is the ESI scheme funded?

The ESI scheme is self-funded through monthly contributions from both employers and employees, calculated as a percentage of wages. Additionally, state governments cover one-eighth of the medical benefits’ costs.

Q.4 What types of businesses fall under ESI coverage?

The central government mandates that all factories with 10 or more employees are subject to the ESI Scheme. This includes:

Shops- Hotels or restaurants without manufacturing operations, only handling sales.

- Cinemas, including preview theaters.

- Road Motor Transport Businesses.

- Newspaper publishers.

- All private educational and medical facilities.

Q.5 Who sets the contribution rate for the ESI scheme?

The Government of India determines the contribution rates, adjusting them periodically. As of June 2019, the contribution rate for employees is set at 0.75% of wages, and for employers, 3.25%.

Q.6 Is ESIC mandatory for all employees?

Yes, ESIC coverage is obligatory for all establishments under the ESI Act, including factories employing over 10 workers and paying wages below Rs 21,000 monthly (Rs 25,000 for employees with disabilities). Those earning above Rs 21,000 are exempt from ESI contributions.

Q.7 What is the mandatory contribution rate for EPF?

The statutory contribution rate is 12% of the basic salary plus dearness allowance up to Rs 15,000 per month. Employees can opt for higher contributions upon approval from the Provident Fund board.

Q.8 Are there restrictions on withdrawing EPF?

Employees resigning from service, other than for retirement, can only withdraw their PF funds after a two-month waiting period

Q.9 Can employees transfer their PF accounts upon changing jobs?

Yes, employees can transfer their PF account to a new employer by submitting Form 13. The transfer process can be completed online.

Q.10 How does EPFO apply interest to EPF accounts?

EPFO credits interest based on monthly balances in the EPF accounts, with the annual interest rate announced each financial year. For FY 2023-24, the rate is 8.25%.

In conclusion, EazeMax stands out as an all-in-one solution for both statutory compliance and personal management. This versatile software simplifies the management of critical statutory requirements like PF (Provident Fund) and ESI (Employees’ State Insurance), ensuring compliance with government regulations effortlessly. It allows businesses to seamlessly handle employee benefits and welfare, reducing administrative workload and minimising the risk of non-compliance.

Additionally, EazeMax software offers powerful personal management features, helping users balance professional and personal life efficiently. With its comprehensive capabilities, EazeMax enhances organisational productivity while ensuring complete adherence to statutory requirements.

Disclaimer: The information provided here is sourced from reliable and verified resources and published after careful review. However, any inaccuracies or changes in details should be regarded as human error. Our blog aims to deliver updated content, and we welcome any queries related to the blog’s subject matter. Please note that we do not offer consultancy services and, therefore, cannot respond to such requests. Our responses are based on practical insights, and we recommend cross-verifying information with professional authorities for complete accuracy.