For long-serving employees, Gratuity is a reward. Gratuity in India is regarded as one of the prime contributors to an employee’s retirement chest. If you are running a business or are overseeing the payroll for your organization and if you have an employee who has finished 5 years or close to 5 years then the employee becomes eligible for gratuity.

On 21st August 1972 The Payment of the Gratuity Act, 1972 was first introduced and was passed by the Parliament of India. From 16th September 1972, it became applicable. Under the latest eligibility rules for gratuity, the organizations that comprise 10 or more employees come within the act.

Eligibility Criteria of Gratuity

To qualify for gratuity benefits under the Payment of Gratuity Act, 1972, an employee is required to have a minimum of five years of uninterrupted service with the same employer. Below, you’ll find a complete list of points related to the gratuity eligibility criteria.

In What way do you Compute your Employees for Gratuity Eligibility?

The basic rule is that if an employee has completed 5 years of continuous service with a single employer then they become eligible for gratuity. However, this rule would not be applicable to some employees who will still be qualified for gratuity in the case of their death or disability during their service even when they have not completed 5 years of service.

Calculating Continuous Service

The gratuity is based on time, therefore it is significant in how continuous service is computed. Any employee who proposes their streamlined service to their organization, leaving out absences that aren’t any fault of the employee, is acknowledged to be in continuous service.

A Summary of the Eligibility Criteria

There are stringent eligibility criteria that your employees need to fulfil, as gratuity is a lump sum. Your employees will be qualified to get the gratuity if-

- They have retired from the job.

- They have resigned post furnishing 5 years of service in your company.

- Some people have either died or become unable to take care of themselves due to sickness or an accident.

Calculation of Gratuity for Employees

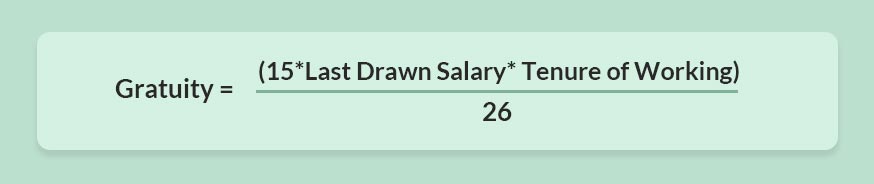

Employers to compute gratuity in India use a formula-based approach, where the gratuity payable depends on two factors:

- The employee’s last drawn salary amount

- Years of service

To evaluate gratuity, the Payment of Gratuity Act has classified non-government employees into two classes- employees who are covered under the act and those who aren’t.

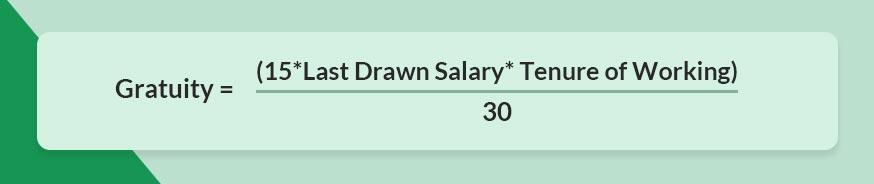

Main Formula for Gratuity

The last drawn salary includes basic pay, dearness allowance, and sales commissions.

Example: Let us assume the last drawn salary of the employee is ₹ 70,000, and the employee has worked with the company for 20 years and 8 months. The formula to compute gratuity will be: (15 * 70,000 * 21) / 26

We are acknowledging the working tenure to be 21 years as the employee has worked already for more than 6 months into their 21st year of employment. 20 years shall only be considered if the employee has worked for 20 years and 5 months.

Non-covered Employees’ Gratuity Formula

The last drawn salary comprises the basic pay, dearness allowance, and sales commissions.

Example: Let us assume the last drawn salary of the employee is ₹70,000, and the employee has worked with the company for 20 years and 8 months. The formula to compute gratuity will be: (15 * 70,000 * 20) / 30

We are acknowledging the working tenure to be 20 years as in the same situation only the number of completed years is been taken into account.

How to Calculate Gratuity Taxes

Depending on your employee’s eligibility to get the gratuity there are three distinct ways in which tax shall be imposed on your employees.

If it is a government employee (under either central or state government) who is qualified for the gratuity then they shall be waived from the income tax.

For the employees who are counted under the Payment of the Gratuity Act, merely the last 15 days of the drawn salary will be waived from income tax.

For employees who do not come under the payment of the gratuity act, then the least of the following 3 amounts will be waived from income tax.

- ₹ 10 lakh

- The actual amount of gratuity received

- One-half month’s salary for every year of employment that the employee has completed with the employer

Gratuity Payment to Employees

Irrespective of your long-serving staff loyalty there are certain cases in which you can keep the whole gratuity amount or collect a partial amount back as outstanding dues.

If any of your employees are terminated because of his/her unethical behaviour at work or absence of respect despite repeated warnings or even end up damaging your office property, then you can deduct these from their gratuity pay.

To cover these expenditures, the businesses are also permitted to take an insurance policy from LIC. If your employees show violent behavior or break laws then as an employer you can completely forfeit the gratuity payout of your employees.

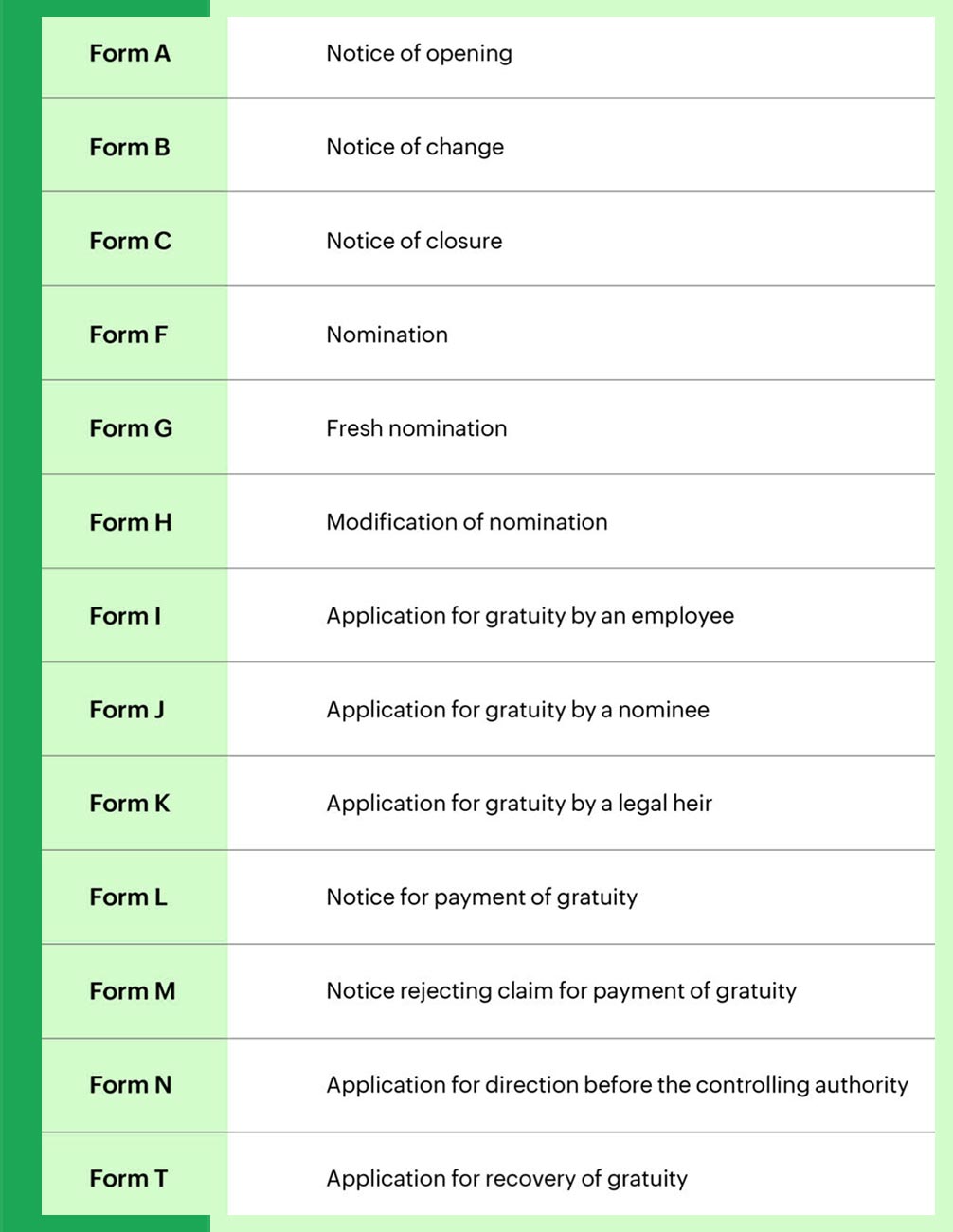

Gratuity Compliance Fillable Forms

You must ensure the below-mentioned important Gratuity compliance forms. All are listed with their objectives.

Source URL:- Payment of Gratuity Act